- 480-597-1743

New economic policies often accompany a new administration, and tax changes take center stage. As President Trump plans extensive tax reforms, questions arise about their effects on individuals, businesses, and the broader economy. Will cuts in corporate taxes and personal income brackets spur growth, or will other monetary policies overshadow them? How will tariffs interact with these policies, potentially offsetting benefits or adding challenges? What impact will these changes have on retirees and wealth-building strategies?

This article explores the intricacies of potential tax changes under the new administration. By examining historical precedents, insights from experts, and projected outcomes, we aim to shed light on how these reforms might influence investment strategies, market behavior, and long-term financial planning.

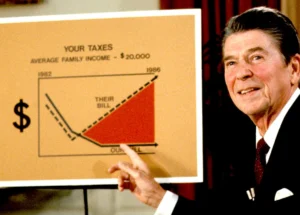

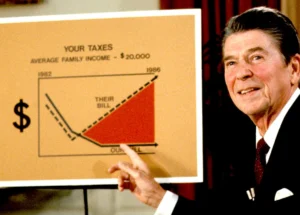

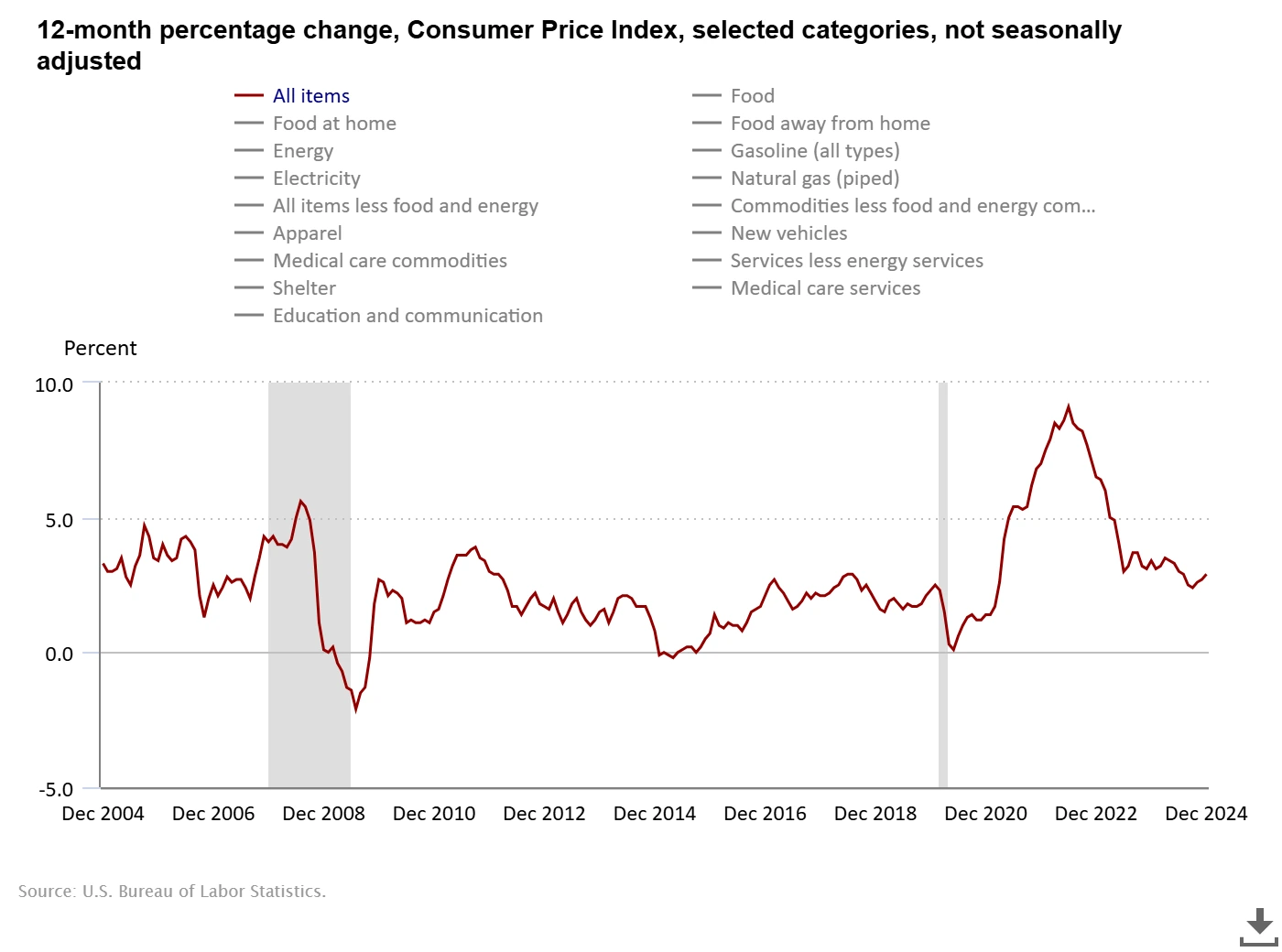

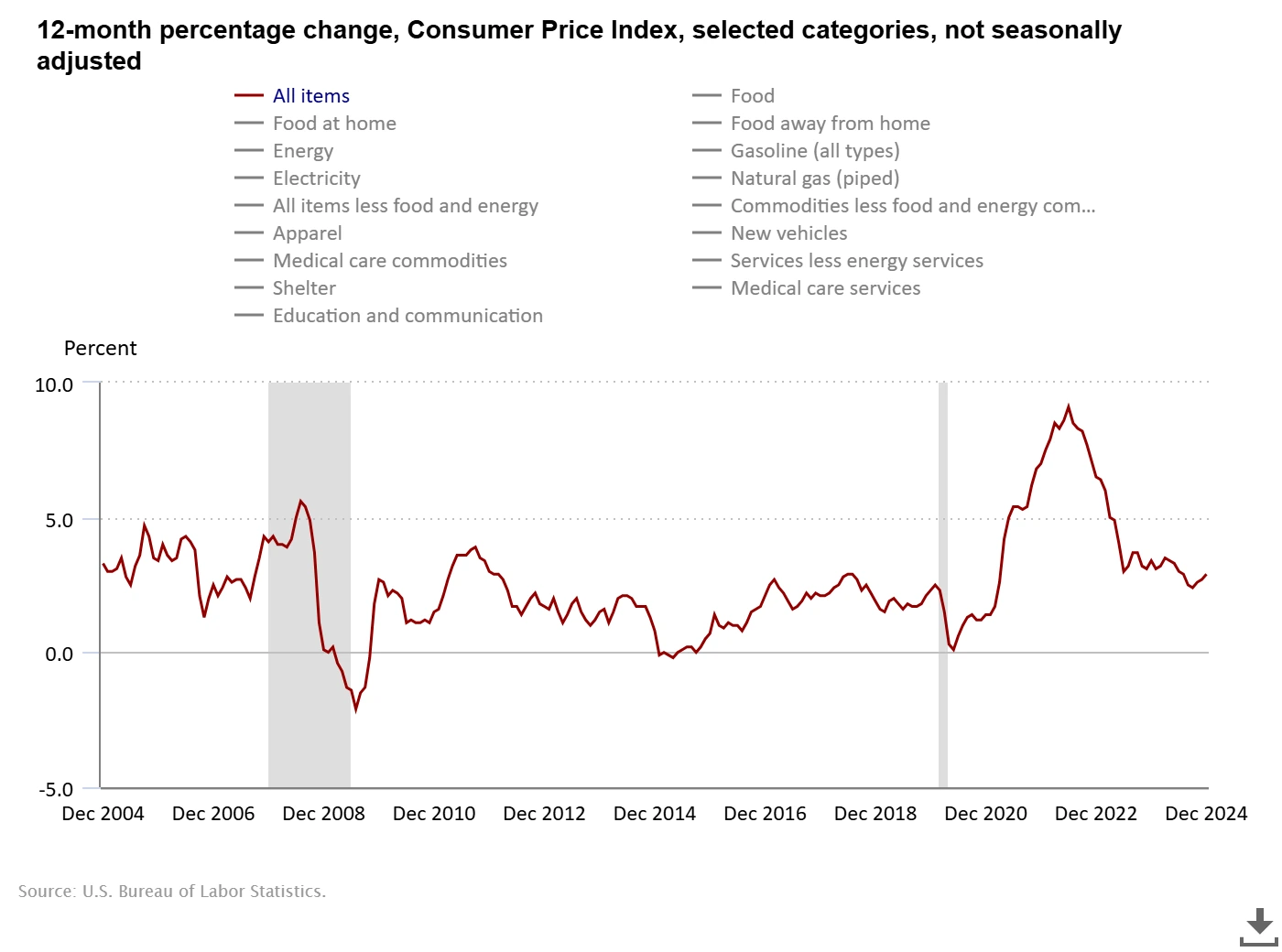

Tax reform has long been a tool for shaping economic paths, often with mixed results. By examining historical examples such as the Economic Recovery Tax Act of 1981 and the TCJA of 2017, we can gain a deeper understanding of how tax policy impacts growth, equity, and fiscal health.

The Economic Recovery Tax Act of 1981:

The Tax Cuts and Jobs Act of 2017: In 2017, the TCJA aimed to stimulate growth and enhance U.S. competitiveness. By lowering the corporate tax rate from 35% to 21% and introducing temporary individual tax cuts, the legislation achieved mixed results:

These examples underscore the need for balanced strategies that maximize immediate benefits while minimizing unintended long-term consequences.

Proposed tax changes have far-reaching implications for individuals, businesses, and the broader economy. Key considerations include:

Tax policy changes necessitate proactive planning for personal and estate financial strategies. The SECURE 2.0 Act and upcoming legislative changes set the stage for 2025 and beyond. Key updates include:

Tax policy changes, whether immediate or long-term, introduce complexities that require strategic planning. By understanding the historical context and analyzing the proposed reforms, individuals and businesses can position themselves to navigate challenges and seize opportunities. Retirees, wealth-builders, and those with estate planning needs should remain proactive in adjusting their financial strategies, leveraging expert guidance to align with evolving laws and ensure their long-term goals are met.

Stay tuned for our next article exploring the history of American markets during periods of severe change. At SG Wealth Managers, we’re committed to helping you navigate economic shifts with confidence.

Disclosure: This is an informational article and should not be taken as financial advice. Always contact your financial advisor to understand how these trends may affect your specific situation. SG Wealth Managers does not take any political sides, and as such, will not make any commentary that is political in nature; rather, this is strictly an economic and financial discussion. Neither the information nor any opinion expressed comprises a solicitation for the purchase or sale of any security. This content is directed exclusively for the purpose of general education.

I am the CEO of SG Wealth Managers, a registered investment advisory firm. One of my favorite things to do is learn something new every week, whether about investing or another subject.

The estate services team for SG Insurance & Estate Services, LLC assists with providing general education services for estate planning, asset protection, legacy planning, and tax strategies. SG Insurance & Estate Services is not a law firm, cannot give legal advice, and does not prepare legal documents. For legal advice and/or representation, all clients are able to consult separately with an estate planning attorney or law firm.