- 480-597-1743

Interest Rates are some of today’s hottest headlines, or so it seems, on everything from financial outlets to social media platforms. This article represents the second in a series of special educational articles provided by SG Wealth Managers, in advance of the 2025 presidential inaugural address. For a long time now, President Trump has been clearly expressing his intention for lower interest rates, with Chairman Jerome Powell acting very prudent—not jumping one way or the other too rapidly. We will see how changes in interest rates trickle down into the economy, focusing on what that could mean for technology stocks, bonds, and how to invest in them.

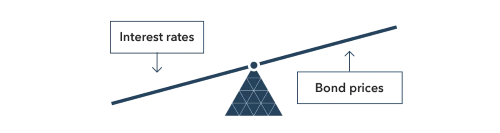

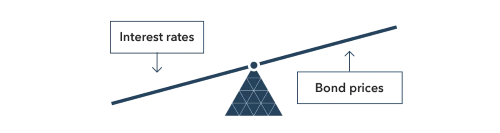

The cornerstones of economic policy are interest rates and how they move, since every rise or fall in interest rates affects borrowing costs, consumer spending, and corporate investment. In the last couple of years, the Federal Reserve has been keeping rates high in order for inflation to spiral down and economic stability to be attained. We enter 2025 with the federal funds rate at 4.48% (as of December 2024), far from the near-zero rates of recent years. President Trump’s vocal support for rate cuts has been consistent with the pro-growth agenda of trying to accelerate economic activity. However, the comments by Jerome Powell suggest otherwise—he is committed to rate maintenance as a means of keeping inflation at bay. This divergence creates some important questions for investors on the possible implications for different asset classes.

To start to appreciate what the interest rate debate means from the perspective of broader implications, now consider two of almost endless possibilities:

Lessons for Investors:

Interest rate policy underlines the importance of a proactive, flexible investment strategy. Key considerations include:

President Trump’s push for lower rates reflects his administration’s broader economic goals. Investors who want to position themselves in line with macro-events must therefore understand the entangled dialogue between fiscal and monetary policy. In our article tomorrow, another important topic will be discussed: trade policies. We will show how trade wars, tariffs, and international agreements may impact the U.S. economy and global markets.

Interest rates represent one of the most significant levers in economic policy. With the new administration and Federal Reserve forging their respective paths, the need for vigilance and nimbleness from investors remains strong. At SG Wealth Managers, we’re dedicated to bringing clarity and action to help you understand the shifts as they unfold. If you have any questions regarding how interest rates affect your portfolio, or if you’d like to discuss your financial plan in detail, please don’t hesitate to reach out to your advisor. Together, we’ll ensure your strategy remains on track with your goals.

Stay tuned for tomorrow’s article on trade policies and their market implications. At SG Wealth Managers, we’re here to support you through every turn of the economic cycle.

Disclosure: This is an informational article and should not be taken as financial advice. Always contact your financial advisor to understand how these trends may affect your specific situation. SG Wealth Managers does not take any political sides, and as such, will not make any commentary that is political in nature; rather, this is strictly an economic and financial discussion. Neither the information nor any opinion expressed comprises a solicitation for the purchase or sale of any security. This content is directed exclusively for the purpose of general education.

I am the CEO of SG Wealth Managers, a registered investment advisory firm. One of my favorite things to do is learn something new every week, whether about investing or another subject.

The estate services team for SG Insurance & Estate Services, LLC assists with providing general education services for estate planning, asset protection, legacy planning, and tax strategies. SG Insurance & Estate Services is not a law firm, cannot give legal advice, and does not prepare legal documents. For legal advice and/or representation, all clients are able to consult separately with an estate planning attorney or law firm.