- 480-597-1743

Welcome to the first in the special series of educational pieces by SG Wealth Managers leading up to the 2025 Presidential Inauguration. In this six-part series, we will be diving deeper into the dynamics of market and economic trends during this extraordinary period of political transition. Understanding how elections and policy changes affect the stock market can help investors and financial planners put things into perspective. Today, we start with a look at the relationship between elections and market movements but also remind you of how important it is to keep a sound, long-term investment strategy in place.

Elections and the stock market have always moved in a very closely related, yet complex, way. Historically, markets have become more volatile during election years due to speculation by investors over possible policy shifts. The 2024 election was no different. Immediately after, the market surged 3.7% in just six days, reflecting optimism about expected pro-business policies. But as of January 14, 2025, the market has retreated 3.8% since mid-December, showing the retracement spurred on by uncertainty.

This no doubt requires an understanding of the investors’ psychology and the way markets react to certain news. Election results bring in optimism and one reason to get concerned, hence giving rise to quick, sometime short-term volatility. It’s very important that as investors, they avoid making decisions based on temporary fluctuations. Rather, it’s important to stick to the fundamental principles of long-term investing.

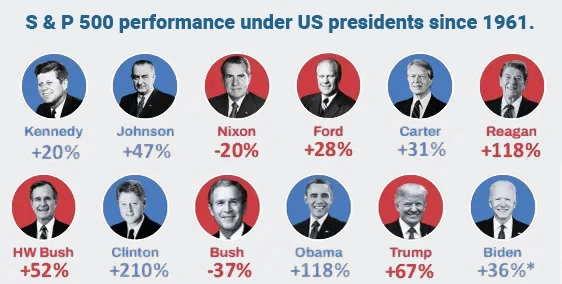

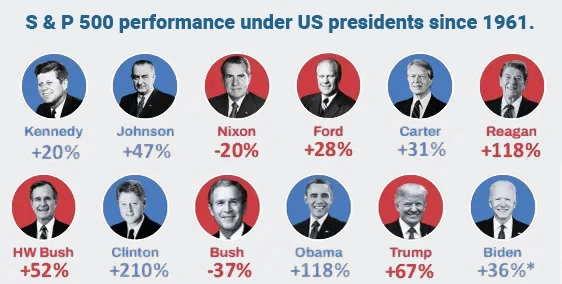

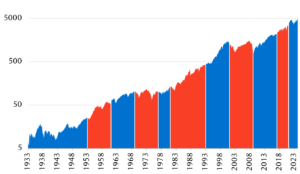

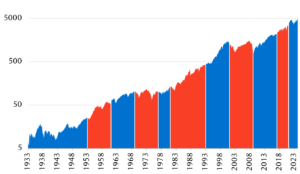

The U.S. stock market has always shown a tradition of reacting to presidential elections.

We can try to analyze the trends of the past for insight into current and future patterns:

While elections may sometimes cause short-term market movements, they should not derail a sound investment strategy. Key principles to discuss this year include:

The 2024 election led to a 3.7% market gain within six days due to optimism over policy changes. However, a subsequent 3.8% decline from December 16, 2024, to January 14, 2025, provides additional context. Several factors influenced this retracement:

Lessons for Investors:

The interplay between elections and markets highlights the need for discipline in investing. Key takeaways include:

As we move further into 2025, the implications of the new administration’s policies will become clearer. Tomorrow’s article will examine interest rates, particularly the tension between President Trump’s preference for lower rates and Federal Reserve Chairman Jerome Powell’s stance. We’ll also discuss potential impacts on tech stocks and bonds.

While elections inevitably influence markets, adhering to sound investment principles ensures resilience. SG Wealth Managers is here to guide you through these times. If you have questions about your portfolio or wish to discuss how market trends impact your financial plan, don’t hesitate to reach out. Together, we’ll keep your strategy on track to achieve your goals.

Stay tuned for tomorrow’s article on interest rates and their implications for investors. We’re here every step of the way!

Disclosure: This is an informational article and should not be taken as financial advice. Always contact your financial advisor to understand how these trends may affect your specific situation. SG Wealth Managers does not take any political sides, and as such, will not make any commentary that is political in nature; rather, this is strictly an economic and financial discussion. Neither the information nor any opinion expressed comprises a solicitation for the purchase or sale of any security. This content is directed exclusively for the purpose of general education.

I am the CEO of SG Wealth Managers, a registered investment advisory firm. One of my favorite things to do is learn something new every week, whether about investing or another subject.

The estate services team for SG Insurance & Estate Services, LLC assists with providing general education services for estate planning, asset protection, legacy planning, and tax strategies. SG Insurance & Estate Services is not a law firm, cannot give legal advice, and does not prepare legal documents. For legal advice and/or representation, all clients are able to consult separately with an estate planning attorney or law firm.