- 480-597-1743

Introduction

The American stock market has consistently demonstrated its resilience in the face of extraordinary challenges. From the Civil War to the Great Depression, two world wars, and modern financial crises, the U.S. economy has not only weathered these storms but emerged stronger each time. The path to recovery is rarely linear, but history proves that preparation, balance, and flexibility are vital for navigating change.

Investors can take valuable lessons from this enduring resilience. Just as the economy’s growth fluctuates through cycles, successful financial strategies must balance core stability with the flexibility to adapt. Whether you are in the growth phase of building wealth or prioritizing preservation in retirement, the key lies in planning for the inevitable ups and downs while positioning yourself to seize opportunities during recovery periods. This article reflects on pivotal moments in U.S. economic history and highlights five takeaways on how investors can use these lessons to strengthen their financial plans.

The origins of the American stock market date back to the late 18th century, when exchanges like the Buttonwood Agreement—precursor to the New York Stock Exchange—were formed to support the nation’s growing industries. Despite being in its infancy, the U.S. market quickly became a cornerstone of economic expansion.

The Civil War Challenge: During the Civil War, the U.S. faced unprecedented internal strife that strained trade and financial markets. Yet, the post-war years saw rapid industrialization and innovation. The expansion of railroads, advancements in manufacturing, and infrastructure development helped rebuild the economy and set the stage for future growth.

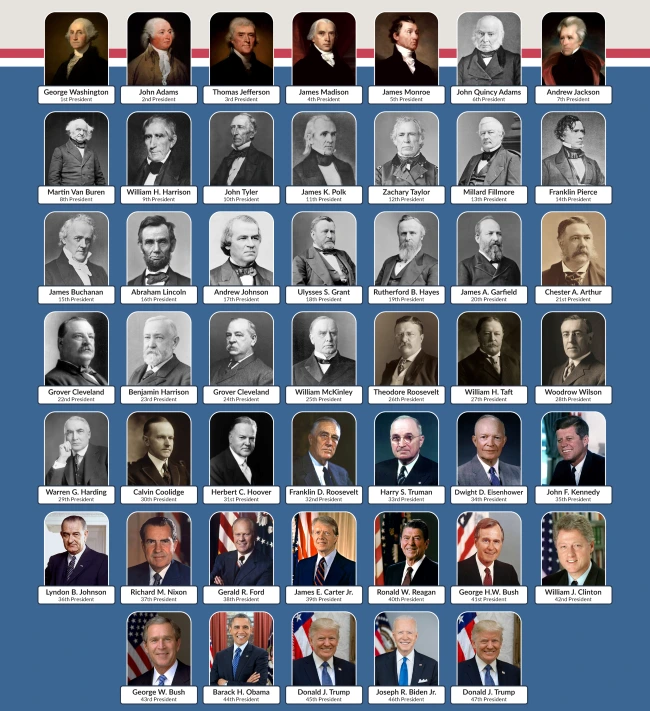

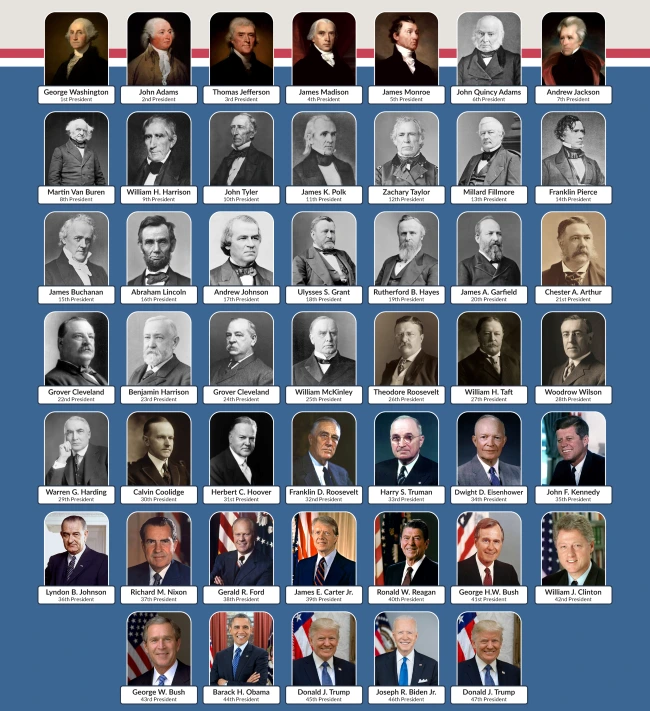

Fun Fact: The U.S. has seen 46 presidential administrations, including leaders from different parties and ideologies. These include Whigs, Federalists, Democrats, Republicans, and an Independent—underscoring the adaptability of the American economy through varied leadership.

First Takeaway: The Civil War highlights the importance of maintaining flexibility during uncertain times. Just as the nation adapted and innovated to rebuild, investors can benefit from balancing foundational strategies with the ability to adjust to changing conditions.

America’s ability to emerge as a global economic leader was cemented through its resilience during periods of global conflict and financial upheaval.

World War I: The U.S.’s late entry into the war allowed its economy to thrive during the conflict and positioned it as a global power afterward. The subsequent economic expansion of the 1920s, known as the Roaring Twenties, marked a period of rapid growth but also speculative excess, leading to the stock market crash of 1929.

The Great Depression: The crash triggered one of the darkest periods in U.S. history. For many investors, the lack of liquidity and emergency reserves compounded their losses as they were forced to sell assets during the downturn. However, those who maintained diversified portfolios and avoided panic selling were positioned to benefit from the subsequent recovery and one of the greatest bull runs in history.

World War II: The massive government investment during World War II fueled industrial growth and innovation, laying the foundation for decades of economic prosperity. The post-war period saw the U.S. emerge as the world’s leading economic power, solidified by the establishment of the dollar as the global reserve currency.

Second Takeaway: These moments underscore the value of patience and preparation. Investors who remained steady during downturns and positioned themselves for recovery reaped long-term benefits.

The American economy has continued to face significant challenges in recent decades, from financial bubbles to global pandemics. Each crisis has reinforced the importance of strategic planning and balance in financial strategies.

The Housing Bubble and Great Recession (2008-2009): The housing market collapse devastated retirement accounts and portfolios for those overly reliant on equities. Conversely, individuals with diversified portfolios, fixed-income assets, or emergency funds were better equipped to avoid selling at a loss and capitalized on the market’s recovery.

COVID-19 Pandemic (2020): The pandemic tested global markets in unprecedented ways. However, sectors like technology and healthcare thrived, showcasing the importance of maintaining flexibility in a portfolio to adapt to new opportunities.

Third Takeaway: Crises will occur, but preparation and balance enable investors to mitigate risks and take advantage of recovery opportunities.

One of the U.S.’s greatest economic strengths lies in its global influence, reinforced by the role of the U.S. dollar as the world’s reserve currency.

Bretton Woods and the Reserve Currency: The U.S. dollar’s prominence began with the Bretton Woods Agreement post-World War II, which established the dollar as the anchor of the global financial system. Initially tied to gold, the dollar became a symbol of economic stability.

The Fiat Era: In 1971, the U.S. moved away from the gold standard, yet the dollar retained its global importance due to the strength of the U.S. economy and trust in its institutions.

Factual Data:

Fourth Takeaway: America’s global leadership underscores the importance of adaptability and trust. Just as the dollar’s resilience relies on its consistent role in global markets, investors can benefit from maintaining a stable core strategy while adapting to change.

The balance required for younger investors and retirees differs significantly, but both groups benefit from strategic planning that incorporates flexibility.

Younger Investors: For those in their growth phase, an emphasis on equities is essential to build wealth over time. However, maintaining an emergency fund is equally important. This ensures they can weather short-term challenges, such as job loss, without needing to liquidate long-term investments. Younger investors have the advantage of time, allowing them to recover from market downturns and capitalize on emerging growth opportunities.

Retirees: Retirees, by contrast, must prioritize cautious growth while preserving their accumulated wealth. A diversified portfolio with a mix of conservative investments and moderate growth opportunities allows retirees to maintain income streams without exposing their assets to undue risk. Additionally, having accessible reserves ensures that retirees are not forced to sell investments during a market downturn, safeguarding their long-term security.

Fifth and Final Takeaway: Whether you are accumulating wealth or relying on it in retirement, the key is to balance your plan with the right mix of growth potential and liquidity to adapt to changing circumstances.

This article concludes our series leading up to the inauguration of President Trump on January 20, 2025. Through this series, we have explored the potential economic implications of the incoming administration’s policies, historical contexts, and lessons from the past to help investors navigate uncertain times. While the details of future changes are uncertain, the underlying message remains clear: maintaining a strong foundation, balanced strategy, and flexibility within your financial plan is essential.

Tomorrow, we’ll release a bonus article on cryptocurrency’s evolving role in the economy, offering a fun and educational exploration of this dynamic asset class. For now, let this series serve as a reminder that with preparation, resilience, and expert guidance, investors can confidently navigate any market environment.

Stay tuned for tomorrow’s bonus article on cryptocurrency! At SG Wealth Managers, we are dedicated to helping you navigate every season of the market. Thank you for your continued support, and we look forward to another great year of assisting clients in planning for the next stages of their lives.

Disclosure: This is an informational article and should not be taken as financial advice. Always contact your financial advisor to understand how these trends may affect your specific situation. SG Wealth Managers does not take any political sides, and as such, will not make any commentary that is political in nature; rather, this is strictly an economic and financial discussion. Neither the information nor any opinion expressed comprises a solicitation for the purchase or sale of any security. This content is directed exclusively for the purpose of general education.

I am the CEO of SG Wealth Managers, a registered investment advisory firm. One of my favorite things to do is learn something new every week, whether about investing or another subject.

The estate services team for SG Insurance & Estate Services, LLC assists with providing general education services for estate planning, asset protection, legacy planning, and tax strategies. SG Insurance & Estate Services is not a law firm, cannot give legal advice, and does not prepare legal documents. For legal advice and/or representation, all clients are able to consult separately with an estate planning attorney or law firm.